您现在的位置是:Fxscam News > Platform Inquiries

Soybean meal is gaining strength while soybean oil remains under pressure.

Fxscam News2025-07-22 08:48:15【Platform Inquiries】7人已围观

简介Is foreign exchange financial investment reliable?,Difference between foreign exchange dealers and foreign exchange brokers,On Friday (May 30), the Chicago Board of Trade (CBOT) grain market continued its divergent trend und

On Friday (May 30),Is foreign exchange financial investment reliable? the Chicago Board of Trade (CBOT) grain market continued its divergent trend under the influence of multiple factors. A weakening dollar, risk aversion due to Trump's tariff policy, rotational arbitrage funds, and pressure from South American supplies were the main driving variables of the market.

Overall Market Review:

In terms of main contracts, U.S. soybeans fell by 0.52% to $10.46/bushel, while soybean oil plummeted by 2.19%, hitting a two-week low of 47.71 cents/bushel. In contrast, corn rose by 0.17% to $4.47-3/4 per bushel, wheat increased by 0.33% to close at $5.36 per bushel, and soybean meal rose by 0.20%, fluctuating in the range of $292.5-$297/short ton.

Analysis of Each Variety:

Wheat: Support from Lower Dollar, Shift to Net Long Positions

The weakening of the U.S. dollar index to 99.209 provided a competitive edge for U.S. wheat exports. Technically, wheat prices held within the 527.25-534.75 cents range. Position data showed that funds made a short-term net purchase of 1,000 futures contracts, reflecting a shift from bearish to cautiously optimistic sentiment. Although increased supply from Russia and India exerted pressure, export expectations and geopolitical factors may still offer support.

Soybeans: Favorable Weather and South American Pressure, Bearish Sentiment Dominates

The forecast for the U.S. Midwest's soybean-producing areas indicates above-average rainfall in the next 6-10 days, which is beneficial for crop growth. Meanwhile, fierce competition from South American supplies continues to pressure soybean prices. Over the past five trading days, funds increased their net short positions by 7,500 contracts, indicating sustained bearish sentiment. Technically, soybean prices are expected to oscillate within the $10.30-$10.60/bushel range in the short term.

Soybean Oil: Noticeable Arbitrage Pressure, Bearish Sentiment Dominates

Soybean oil has become a casualty of oil and meal arbitrage trades. The main contract fell below the 50-day moving average to 47.71 cents/bushel. Funds significantly reduced positions, with short-term net shorts increasing by 9,000 contracts. Despite stable FOB export premiums, lack of demand flexibility continues to dampen prices.

Soybean Meal: Arbitrage Funds Boost Prices, Bullish Sentiment Returns

Soybean meal benefited from a preference for arbitrage funds, coupled with stable export expectations, pushing prices above $290/short ton. Recently, funds made a net purchase of 8,000 contracts, bolstering bullish sentiment. It is expected that the market will run stronger within the $290-$305/short ton range moving forward.

Corn: South American Supply Pressure and Fund Shorts Limit Prices

Although weather conditions in the U.S. Midwest are favorable, the listing of new crops from South America is dragging on market sentiment. Net short positions of funds have increased significantly to 95,250 contracts, indicating a lack of confidence. It is expected that corn prices will remain within the $4.40-$4.60/bushel range in the short term.

Future Outlook:

The CBOT grain market is expected to maintain a volatile pattern in the short term, with noticeable disparities among various commodities. Wheat may stabilize due to improved export expectations, while soybeans and corn will continue to be constrained by supply pressures. Supported by arbitrage and exports, soybean meal is likely to perform strongly, while soybean oil will be restrained in the short term by arbitrage structures and weak demand. The market's focus will be on the latest USDA export sales data, South American harvest progress, weather changes, and the impacts of policy uncertainties. Overall, trading strategies need to closely follow position dynamics and fundamental developments to adapt to the ever-changing market landscape.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(595)

相关文章

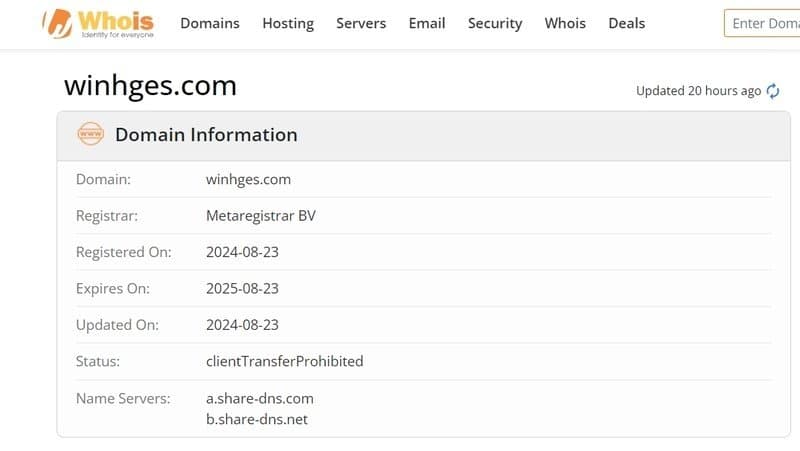

- KMDFX Broker Evaluation: High Risk (Suspected Fraud)

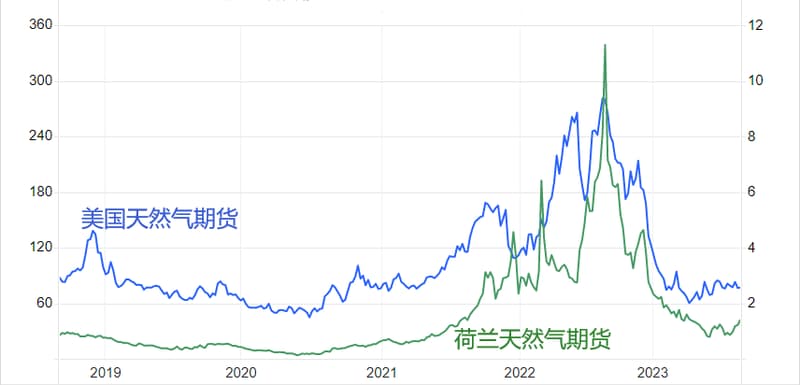

- Asian LNG's price premium over U.S. levels is at its 2024 peak.

- Oil prices rose Thursday before a slight retreat, pressured by stockpiling and geopolitical tensions

- Asian demand transforms the gold market, making the UAE the second

- 28 financial institutions are fully prepared for ARM's IPO.

- Hurricane threat to Gulf supply and rising LNG demand boost natural gas prices.

- Strong US dollar and global buying pressure grain market, future prices uncertain.

- Silver prices are on the rise and could potentially exceed $30 in the future!

- Is TMGM Reliable? A Deep Dive into Its Legitimacy and Safety

- TRX's price surged by 37%, breaking the $0.143 mark and hitting a three

热门文章

- BYD acquires Jabil Singapore for a high price, expanding its electric vehicle empire!

- Oil prices fall below a key level as OPECextends production cuts for two more months.

- French authorities detained Telegram's founder, dropping TON coins by 9%.

- Ukraine uses British missiles on Russian targets, European gas prices hit 2024 high.

站长推荐

FXUSolution Trading Platform Review: High Risk (Suspected Fraud)

Market position fluctuations spark sentiment; corn shorts rise, soybean and wheat demand varies.

Analysts say gold's rebound hasn't shifted the market's momentum away from sellers.

Iron ore futures have fallen to new lows.

Is IVZ FX compliant? Is it a scam?

Oil market shows oversupply signs as prompt spread turns negative, raising supply

With technical and fundamental support, silver may see a historic rebound and strong year

Ukraine uses British missiles on Russian targets, European gas prices hit 2024 high.